extended child tax credit dates

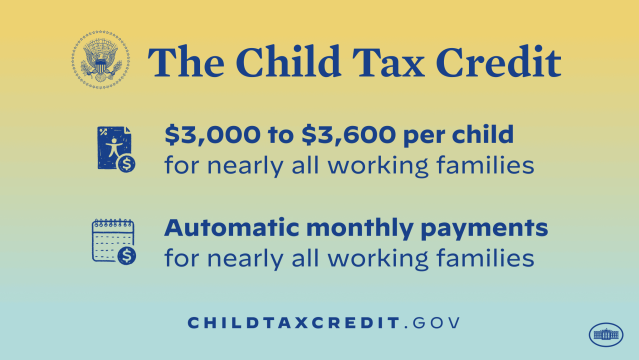

The expanded child tax credit includes up to 3600 per child under age 6 and 3000 per child ages 6 through 17. It also provided monthly payments from July of 2021 to.

Entered your information in 2020 to get stimulus Economic Impact.

. The American Rescue Act of 2021 temporarily increases the Child Tax Credit up to 3600 per child under age six and up to 3000 per child under age 18. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of US. No portion of the credit was refundable so if it reduced your tax liability to zero the excess credit had no.

FAMILIES have grown used to monthly 300 payments through the expanded child tax credit but in February 2022 theres a chance the long-awaited extension could double. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. Get help filing your taxes and find more information about the 2021. 2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and up to 250 per month for.

The Michigan mother of three including a son with autism. 13 opt out by Aug. The temporary changes in effect for 2021 make it a near-universal monthly.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. The Child Tax Credit provided a credit worth up to 1000 per child.

Some payments will be made earlier if theyre due between 27 December 2021 and 4. 15 opt out by Aug. 15 opt out by.

Get this years expanded Child Tax Credit. 15 opt out by Nov. The monthly payments from the expanded child tax credit that have been given to roughly 35 million families in the US.

Making the credit fully refundable. 15 opt out by Oct. This money was authorized by the American.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. It is a credit that reduces taxes owed as opposed to a deduction that reduces taxable income. File your taxes to get your full Child Tax Credit now through April 18 2022.

In 2021 and 2022 the average family will receive 5086 in coronavirus stimulus money thanks to the expanded child tax credit. Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis which. Now if the current payment amounts do not pass in Congress moving forward eligible parents can only receive a.

Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or. For parents who opted out of the advanced child tax credit payments in 2021 they will be able to claim the full credit if they qualify on their 2021 tax return. Over the course of six months last year millions of eligible families received monthly checks for up to 300 from the expanded child tax creditParents can expect more.

During the pandemic will expire at the end of the month. Families will receive a maximum of 3600 for each child under 6 for tax year 2021 and a maximum of 3000 for kids 6 through 17. As part of the American Rescue Plan the Child Tax Credit was expanded for 2021 only to include qualifying children ages 17 and under and increased from 2000 to up to.

The agency says most eligible families do not. Katrena Ross started receiving 300 a month last July as part of the expanded monthly child tax credit payments. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17.

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Bra Extends Personal Income Tax Filing Deadline Barbados Today Filing Taxes Income Tax Tax Filing Deadline

Child Tax Credit 2021 8 Things You Need To Know District Capital

The Gst Bill Was Recently Approved By The Lok Sabha On March 30th And Will Directly Affect Everyone In The Coun Filing Taxes Indirect Tax Goods And Service Tax

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit 2021 8 Things You Need To Know District Capital

Tax Day Deadline In 3 Weeks What Happens If You File A Tax Extension Tax Extension Tax Refund Filing Taxes

The Child Tax Credit Toolkit The White House

What Families Need To Know About The Ctc In 2022 Clasp

Tax Forms Directory Comprehensive Irs Tax Forms Guide Irs Taxes Irs Tax Forms Business Tax Deductions

Child Tax Credit Will There Be Another Check In April 2022 Marca

Pin By Patrick Swinney On Taxable Deductions Child Tax Credit Tax Credits How To Plan

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

First Round Of New California Film Tv Tax Credits Gets 37 Small Screen Applicants California State Movie Business Entertainment Jobs